Importing Returns

The Import feature lets you import one or more returns into ATX if they meet the following criteria:

- Returns where the year matches the ATX year. Returns from prior years should be imported into ATX for the tax year of the return, and then rolled over into the current year. See Rollover Returns from Last Year.

- Returns were created in ATX. Returns created in other products require conversion in order to be imported into ATX. For more on conversions, go to our MyATX Solution Center and click Conversions.

- Returns that were exported from ATX using ATX's Export function. These can be imported on any computer that has the same year of ATX installed (imported return year must match ATX year).

To import returns:

- From the Return Manager, click the Returns menu.

- Expand the Import fly-out menu and select Returns.

The Import Returns dialog box appears.

- Navigate to the return(s) to be imported.

- Highlight the return(s) to be imported.

To select multiple files, hold the Ctrl key while highlighting the files.

- Click Open.

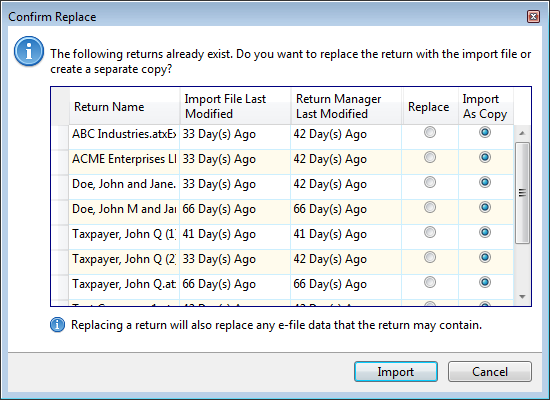

- If there are existing returns that match the returns being imported, the Confirm Replace dialog provides the option to Replace the existing return with the imported return or to Import as Copy (the imported return will be named as a copy and the existing return will not be changed). Select the appropriate radio button for each return listed.

Import as Copy is selected by default.

Confirm Replace dialog box

E-files (including related acknowledgments, bank application records and PDF attachments) are not included if you select Import as Copy...

- Click Import.

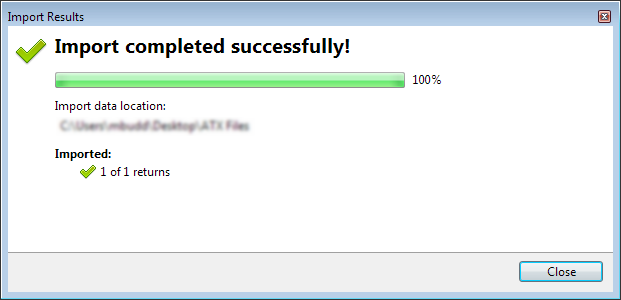

Import Results dialog box (sucessful)

- Click Close.

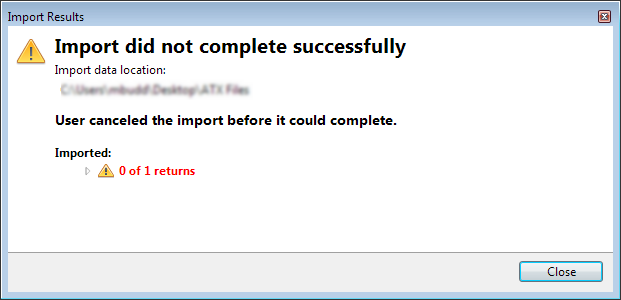

Unsuccessful Imports

Import Results dialog box (partially unsuccessful)

If your imported return has an e-file, you cannot transmit that e-file until you synchronize the e-file with the EFC. (This will ensure that the e-file was not transmitted prior to import). Even if you're not ready to transmit the imported e-file, you may want to sync with the EFC to ensure that the imported return's e-file status, bank status, and ACKs are up-to-date. See Synchronizing E-files With the EFC.

See Also: